If you are selected for verification, one of the common requirements is tax information. We always recommend that you use the IRS data retrieval tool on your FAFSA if you are eligible. Even if you've already submitted your FAFSA, you can always go back in and use the data retrieval tool to submit a second FAFSA. If you aren't able to use the retrieval tool, then you can request free tax document(s) directly from the IRS. Tax documents can be ordered online at www.irs.gov or by calling 800-908-9946. You will have the option of ordering online (immediate receipt) or having it sent in the mail (takes 5-10 business days to arrive).

Before following the instructions below, please identify which tax document(s) you will need:

-

If you filed taxes:

-

Use the Data Retrieval tool on the FAFSA or

-

Request a Tax Return Transcript

-

-

If you did not file taxes AND did not have any income:

-

Request a Non-Filing letter from the IRS or

-

Request a Tax Return Transcript/Account Transcript which indicates "no record found" from the IRS

-

-

If you did not file taxes but did have income:

-

Request a Non-Filing letter from the IRS or

-

Request a Tax Return Transcript/Account Transcript which indicates "no record found" from the IRS

-

AND a copy of all W-2s (or equivalent document) OR the Wage and Income Transcript

-

To order tax documents online:

Launch the website at www.irs.gov and click on “Get Your Tax Record”. The Get Transcript Online tool allows the user to immediately receive an online PDF version of their IRS Tax Return Transcript or, if appropriate, a Wage and Income Transcript.

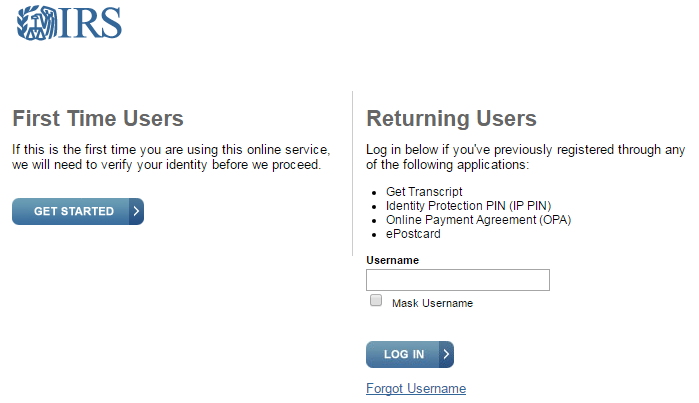

The Get Transcript Online tool uses a new enhanced two-step, multi-factor authentication process that requires the user to register before submitting a transcript request.

The Get Transcript Online tool uses a new enhanced two-step, multi-factor authentication process that requires the user to register before submitting a transcript request.

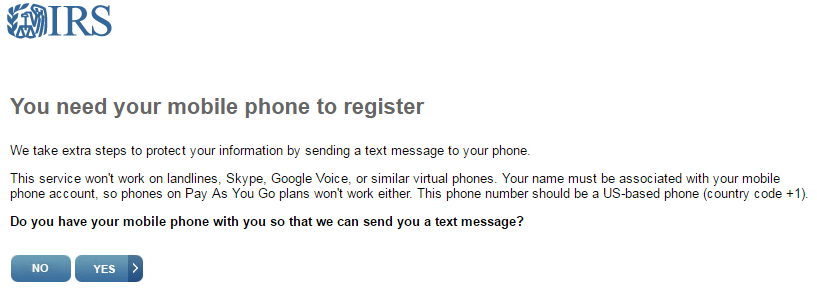

To use the new Get Transcript Online tool, the user must have (1) access to a valid email address, (2) a text-enabled mobile phone (pay-as-you-go plans cannot be used) in the user’s name, and (3) specific financial account numbers (such as a credit card number or an account number for a home mortgage or auto loan). Note that the IRS Get Transcript Online registration process will not result in any charges to the card or to the financial account.

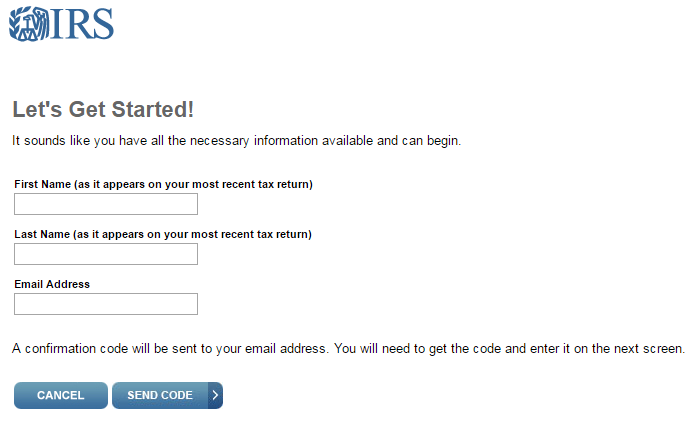

During the new Get Transcript Online registration process, the IRS will send the user a confirmation code via email and an authentication code via text. The IRS email and text will contain a one-time code that the user will use to finalize the Get Transcript Online registration. Note that the IRS will never request log-in information or personal data via email or text.

After confirming the email address you will be taken to the following page:

A tax filer who is not able to successfully register for the Get Transcript Online will be able to request a tax return transcript using one of the following methods:

- Order by Phone

- 800-829-1040

- The IRS can mail transcripts or fax to the student if they can confirm they are standing next to the fax machine

- Local IRS Office

- Students can visit the following link to locate an IRS office near them

- https://apps.irs.gov/app/officeLocator/index.jsp