Accepting Financial Aid

Every academic year you will be asked to accept your financial aid loan funds. To accept your loans, from your Student Portal main page, click on the "My Account and Financial Aid" tab followed by "Financial Aid." This will bring you to a page that shows your available loan funding for your current academic year, as well as a breakdown of how that funding will be disbursed if you remain in an eligible enrollment status.

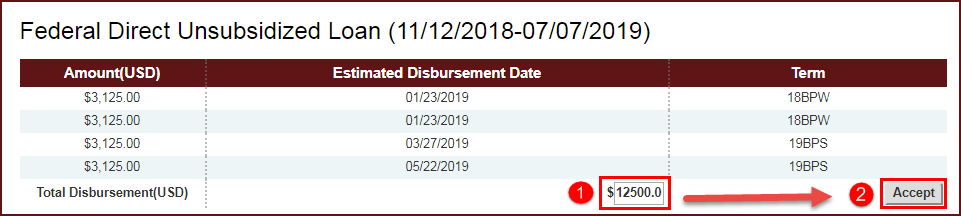

From this page, you may choose the amount of funding you want to accept by clicking on the box that displays your loan eligibility and entering a specific amount. The amount cannot exceed what is already listed but you are welcome to reduce your loan amount if you'd like, especially if it exceeds the cost of your courses. Keep in mind, the loan amount accepted will be divided into 4 equal disbursement amounts.

Accept/Reduce/Decline Loan Amount Process

You can choose to accept the total loan amount, reduce the total loan amount, or decline all of the loan amounts. Please follow these instructions:

Accept: To accept the total amount of the listed loan, simply click "Accept". The total is already calculated for you.

Reduce: To reduce the amount of the listed loan, indicate the requested amount (whole dollars only) and click on "Accept".

Decline: To decline the full amount of the listed loan, click "Decline". This will automatically reduce the total amount to $0.

If you do not take action, funds won't disburse and the offer will automatically be cancelled after 30 days. If after this period you wish to have your loan reinstated, please notify your Student Finance Advisor.

Federal Loan Fees

Keep in mind that Direct Loans have origination fees that are taken out of the total amount of your loans prior to them being received at the school. We recommend that you account for a fee of approximately 1.057% for Direct Subsidized & Unsubsidized Loans and 4.228% for Direct PLUS Loans to ensure that you have enough net funding to cover your expected charges. Please be sure to account for this additional fee when reducing your loan amounts.

Federal Loan Default Prevention

CSU Global has partnered with IonTuition to support students in managing their federal loan repayment. IonTuition provides counseling and online tools to help students manage their student loan repayment, free of charge. If you have already registered for an account with IonTuition, their user portal can be located through this link.